Welcome to Dental Buyer Advocates

I’m Brian Hanks. My team and I only help dentists, we only work with buyers, and we work nationwide. We specialize in helping dentists like you with one of the most important career decisions you’ll ever make.

Check out this comprehensive dental practice acquisition checklist to learn about the road ahead.

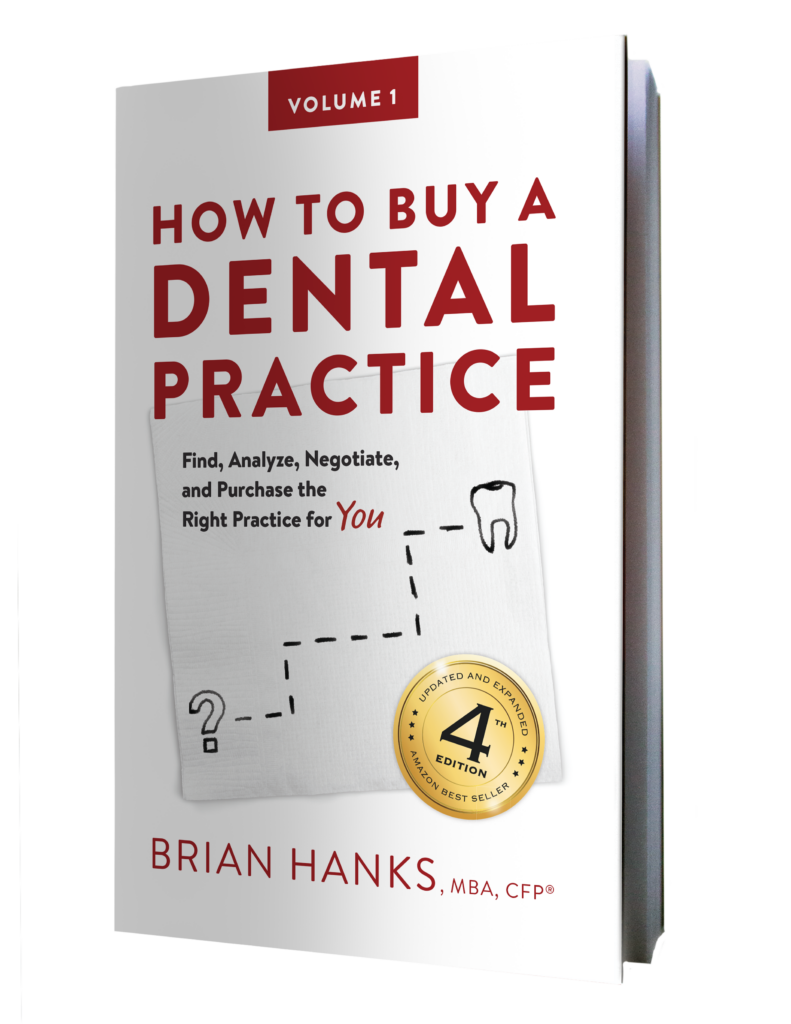

HOW TO BUY A DENTAL PRACTICE

Find, analyze, negotiate, and purchase for the right price.

WORK WITH US

Together we will take a deep dive into the practice you are looking at and objectively assess the opportunity. This is one of the biggest, most important career decisions you will make as a dentist, so it’s important to get this right.

Our Engagement is broken down into 3 phases.

– SEE DETAILS BELOW

CONNECT WITH BRIAN

"I want you to feel confident as I guide you through one of the biggest financial decisions of your life. Former clients tell me the biggest mistake most dentists make when buying a practice is WAITING TOO LONG. Let me help you feel confident in knowing how to buy the right dental practice." - Brian

Where are you Stuck?

Whether you’re trying to find a practice or have already closed on one, we provide expert guidance for every aspect of the deal. Click any of the links below to learn more.

Finding a Practice

It all starts with finding the perfect dental practice for you.